How To Transfer Maybank To Barclays Bank @ Malaysia To Oversea United Kingdom (UK) Experience

Well, I was wondering whether my UK Barclay's bank account still active or not when I saw my the Barclay's bank debit card on my table. Apparently I tried to login back my UK Barclays account yesterday using the PINsentry card reader below.

I'm able to login and just realized it had almost expire soon and the balance still left a total of £0.80 as below.

Somehow I tried to call their customer service UK number as I'm unable to login the Barlcays mobile banking apps since I no longer can download Pingit. Furthermore, I am curious whether I'm still able to transfer money into Barclays from my local Maybank Malaysia bank account and it shows that the Maybank2u.com Foreign TT service is offline now.

It is only available during 10am to 6pm from Monday to Friday.

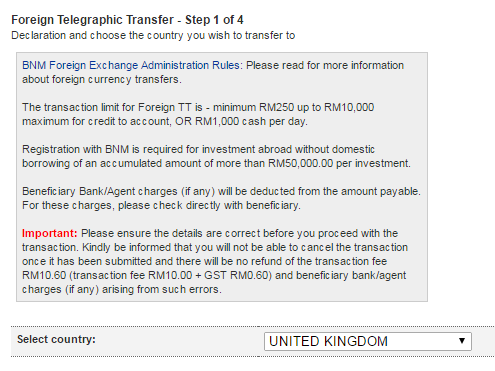

During the afternoon, I decided to do the Foreign Telegraphic Transfer from my Maybank to Barclays bank account since it is my first time to transfer money to oversea's bank account. Hereby I would like to share some of my personal experience for doing my first online transfer experience from Malayia to United Kingdom (UK) country. First of all, login to your Maybank and select "Transfer", then click "Foreign Telegraphic Transfer" tab.

Basically there are steps to follow as below.

1) Select the country that you wish to transfer to and please note that the minimum amount to do foreign transfer is RM250.

2) Choose the currency and type in the currency amount that you wish to change in the (RM) column and fill up all the necessary transfer details info. (The GBP exchange rate for today £1 = RM5.5790.

3) As for the beneficiary info, I just type the Sheffield Barclays branch that I went to register previously which is (12 Pinstone St, Sheffield, South Yorkshire S1 2HN, United Kingdom)

The SORT Code is the first 6 digit number at bottom left side and account number is at the right side of your Barclay's Visa debit card.

4) Just review and confirm transfer the info is correct, then click Request "TAC" below.

5) After key in your TAC code, your transfer is success and you will go to the following screen.

Well, I don't recall that I need to key in the Barclay's Swift Code (BIC) which is "BARCGB22" in order to proceed. Kindly take note that there is a service charge of RM10 for this International money transfer.

Below is some important Frequently Ask Question (FAQ) to take note when transfer with Maybank.

________________________________________________

a) Will my Foreign TT be rejected after the transaction is completed?

Your TT will only be rejected by the beneficiary bank if the beneficiary details are incorrect. The RM10 bank fee and beneficiary bank/agent charges (if any) are not refundable if your Foreign TT is rejected by the beneficiary bank.

b) What is the daily transaction limit for foreign fund transfers via Maybank2u.com?

The minimum for both Cash and Credit to Account transactions is RM250, while the maximum per day is RM10,000 for Credit to Account and RM1,000 for Cash. You may perform more than one transaction per day - either Credit to Account, Cash, or both, up to the maximum amount only, e.g. if you transfer RM1,000 via 'Payment by cash mode', you may also choose 'Credit to account' transfers on the same day up to a maximum of RM9,000.

c) Can I use Maybank2u.com Foreign TT service 24 hours a day?

The online foreign telegraphic transfer service is only available from Monday to Friday, 10.00am to 6.00pm, excluding public holidays and Federal Territory state holidays.

d) How long will it take for the recipient to receive the money?

Your Foreign TT will be sent via SWIFT straight-through processing, but the actual time taken will depend on the respective agent or recipient's bank.

e) Why must I state the 'Purpose of Transfer'?

The 'Purpose of Transfer' declaration is a compulsory Bank Negara Malaysia requirement for all foreign fund transfers exceeding RM5,000.50 (five thousand ringgit and fifty sen). This field is displayed only if the value of your transfer exceeds RM5,000.50.

________________________________________________

During the night, I login back to my Barclay's bank account and found the transfer was successful as the available balance shown is £44.81 below at Student Additions account.

I was quite amazed that the transaction is quite fast it is done within half day. After that, I just transfer half of it to Everyday Saver account.

The reason to do so is to see which account will pay interest as I recall that the Barclay's bank will pay interest every week even though it is just £0.01 per week. This blog post is just serve as a guidance for student who want to receive money from Malaysia to their oversea bank account because I couldn't search any real experience from people who done it. On the other hand, feel free to read my about "How To Transfer PayPal Money To Maybank And Other Local Bank In Malaysia" blog post if you wish to know more about getting oversea payment using local bank account. At last, I guess I will transfer back this money back to my Maybank since the Barclays bank seems to be expiring soon.

>.<

I'm able to login and just realized it had almost expire soon and the balance still left a total of £0.80 as below.

Somehow I tried to call their customer service UK number as I'm unable to login the Barlcays mobile banking apps since I no longer can download Pingit. Furthermore, I am curious whether I'm still able to transfer money into Barclays from my local Maybank Malaysia bank account and it shows that the Maybank2u.com Foreign TT service is offline now.

It is only available during 10am to 6pm from Monday to Friday.

Basically there are steps to follow as below.

1) Select the country that you wish to transfer to and please note that the minimum amount to do foreign transfer is RM250.

2) Choose the currency and type in the currency amount that you wish to change in the (RM) column and fill up all the necessary transfer details info. (The GBP exchange rate for today £1 = RM5.5790.

3) As for the beneficiary info, I just type the Sheffield Barclays branch that I went to register previously which is (12 Pinstone St, Sheffield, South Yorkshire S1 2HN, United Kingdom)

The SORT Code is the first 6 digit number at bottom left side and account number is at the right side of your Barclay's Visa debit card.

4) Just review and confirm transfer the info is correct, then click Request "TAC" below.

5) After key in your TAC code, your transfer is success and you will go to the following screen.

Well, I don't recall that I need to key in the Barclay's Swift Code (BIC) which is "BARCGB22" in order to proceed. Kindly take note that there is a service charge of RM10 for this International money transfer.

Below is some important Frequently Ask Question (FAQ) to take note when transfer with Maybank.

________________________________________________

a) Will my Foreign TT be rejected after the transaction is completed?

Your TT will only be rejected by the beneficiary bank if the beneficiary details are incorrect. The RM10 bank fee and beneficiary bank/agent charges (if any) are not refundable if your Foreign TT is rejected by the beneficiary bank.

b) What is the daily transaction limit for foreign fund transfers via Maybank2u.com?

The minimum for both Cash and Credit to Account transactions is RM250, while the maximum per day is RM10,000 for Credit to Account and RM1,000 for Cash. You may perform more than one transaction per day - either Credit to Account, Cash, or both, up to the maximum amount only, e.g. if you transfer RM1,000 via 'Payment by cash mode', you may also choose 'Credit to account' transfers on the same day up to a maximum of RM9,000.

c) Can I use Maybank2u.com Foreign TT service 24 hours a day?

The online foreign telegraphic transfer service is only available from Monday to Friday, 10.00am to 6.00pm, excluding public holidays and Federal Territory state holidays.

d) How long will it take for the recipient to receive the money?

Your Foreign TT will be sent via SWIFT straight-through processing, but the actual time taken will depend on the respective agent or recipient's bank.

e) Why must I state the 'Purpose of Transfer'?

The 'Purpose of Transfer' declaration is a compulsory Bank Negara Malaysia requirement for all foreign fund transfers exceeding RM5,000.50 (five thousand ringgit and fifty sen). This field is displayed only if the value of your transfer exceeds RM5,000.50.

________________________________________________

During the night, I login back to my Barclay's bank account and found the transfer was successful as the available balance shown is £44.81 below at Student Additions account.

I was quite amazed that the transaction is quite fast it is done within half day. After that, I just transfer half of it to Everyday Saver account.

The reason to do so is to see which account will pay interest as I recall that the Barclay's bank will pay interest every week even though it is just £0.01 per week. This blog post is just serve as a guidance for student who want to receive money from Malaysia to their oversea bank account because I couldn't search any real experience from people who done it. On the other hand, feel free to read my about "How To Transfer PayPal Money To Maybank And Other Local Bank In Malaysia" blog post if you wish to know more about getting oversea payment using local bank account. At last, I guess I will transfer back this money back to my Maybank since the Barclays bank seems to be expiring soon.

>.<